As an investment adviser, you may wonder what proportion of my clients’ assets should be allocated to private equity? This article will show you the types of investors who traditionally invest in private equity, how much of their portfolio they allocate to private equity, and how to identify clients whose investment goals are best suited to investing in this asset class.

What is Private Equity?

The term ‘private equity’ can be used to describe any kind of investment in a private company. It is sometimes used to describe investments such as mezzanine debt, distressed debt, or leveraged buyouts.

For the purposes of this article, the term ‘private equity’ refers to an investment in a company that is not listed on the stock market.

InvestX provides members access to indirect investments in mid- to-later-stage private companies – companies that have gone through the initial risk curve, have already raised millions of dollars from big-name venture capital firms, and may already have growing revenues and a path to profitability.

Why Do People Invest in Private Equity?

Undervaluation – Private companies are valued comparatively lower than their publicly-traded counterparts. One of the reasons for this is the lack of liquidity. Unlike on the public markets, shares in a private company cannot be traded on a daily basis. Since it is more difficult to sell, the value of shares in a private company drop accordingly.

Superior Returns – Over the past ten years, private equity and venture capital have had the highest average returns of any asset class:

Chart Sources:

a https://www.cambridgeassociates.com/private-investment-benchmarks/ (Data Acquired from Cambridge Associates’ Q4 2017 Preliminary Report)|

b https://www.blackrock.com/investing/literature/investor-education/asset-class- returns-one-pager-va-us.pdf

c http://www.1stock1.com/1stock1_766.htm

It would be very difficult to maintain an average annual return of 11.8% investing only in public stocks and bonds.

Summary of Private Equity Characteristics

Private equity investments have been a top-performing asset class, yielding an average 11.8% return over the past 10 years. Private equity is a comparatively illiquid asset class, with terms generally ranging from 3 to 7 years. This makes it a desirable asset class for investors who seek higher portfolio growth, with the ability to invest their money for a longer term.

Who Invests in Private Equity, and How Much Do They Invest?

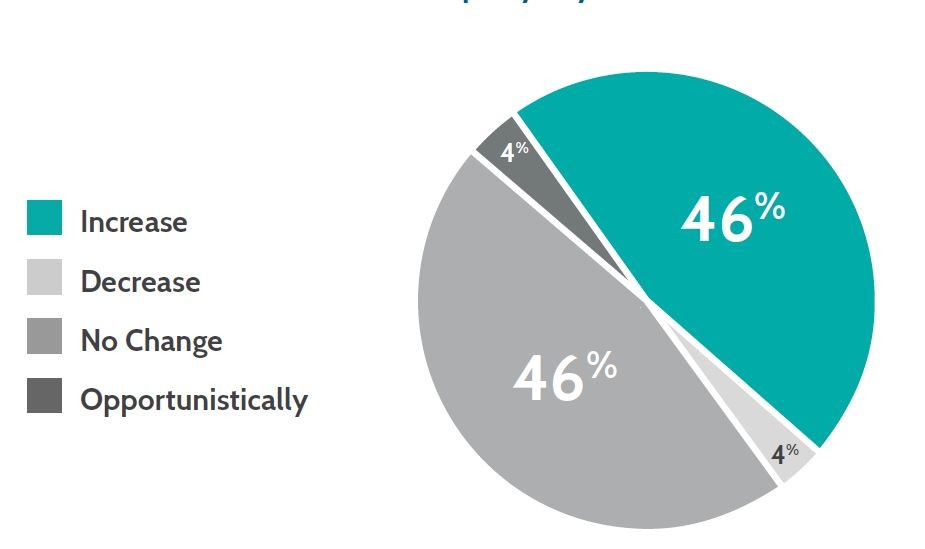

Until recently, private equity was exclusively owned by big institutional investors and ultra high net worth investors. While accredited investors may now also access private equity, most access is still limited to the same big institutions that have always invested in it. According to a report on private equity by Ernst & Young, 46% of investors expect to increase their capital allocations to private equity:

Source: EY 2015 Global Private Equity Survey

How Much Do Endowment Funds Invest in Private Equity?

Lately, university endowment funds – particularly Ivy League endowment funds – have garnered attention for their market-beating returns. One thing that most endowment funds have in common is that they allocate a significant portion of their portfolio to private equity. The endowment funds of some of the top universities in the United States allocate between 20% and 40% of their portfolios to private equity:

Source: http://markovprocesses.com/blog/2015/11/mpi-dsa-unlocks-top-endowment-performance-1/

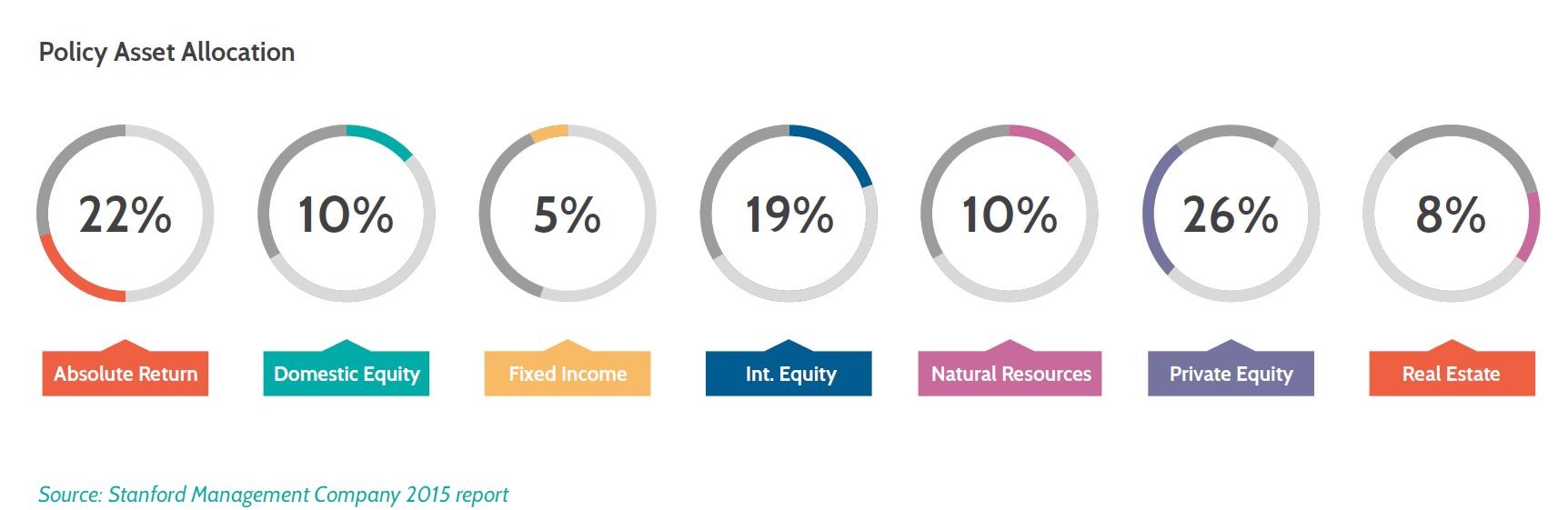

Private equity is the most highly-allocated asset class in the Stanford endowment. According to the Stanford Management Company, the entity managing Stanford’s endowment fund:

Private equity is the most highly-allocated asset class in the Stanford endowment. According to the Stanford Management Company, the entity managing Stanford’s endowment fund:

“The portfolio is heavily oriented towards

equities to provide a high expected return, and

well-diversified to reduce risk and mitigate

excess volatility. Befitting an institution with a

multi-generational perspective, the portfolio is

invested with a long-term horizon.” 2

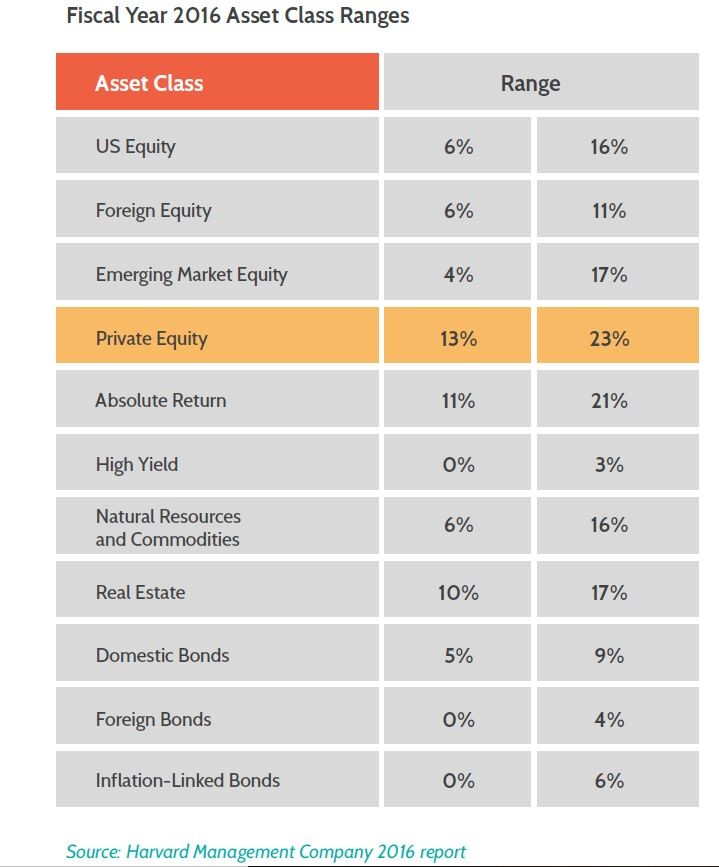

Private equity is also the most highly-allocated asset class in the Harvard endowment. The following Chart shows the Harvard Management Company asset class allocation ranges for 2016:

Private equity has helped some of the largest endowment funds in the world generate market-beating returns.

How Much Do the Ultra-Wealthy Invest in Private Equity?

Private equity is also a favourite asset class of high net worth and ultra high net worth individuals.

TIGER 21, a peer-to-peer learning network for high-net-worth investors, reports that investment in private equity continues its upward trend, increasing over the past decade from a low of 10% to a high of 23% in the first quarter of 2016, the highest rate ever recorded for the group.

According to the report, TIGER 21 peers, all of whom are high net worth or ultra high net worth, are increasingly allocating their portfolios to private equity to offset suboptimal returns in the public markets.

Sources:

1 https://www.entrepreneur.com/article/41972

2 Stanford Management Company 2015 report

3 https://tiger21.com/market-conditions-spur-investment-private-equity

Recent Posts

- InvestX Q4 Highlights and Q1 2024 Outlook – US 29th Feb 2024

- InvestX Q4 Highlights and Q1 2024 Outlook – CA 29th Feb 2024

- InvestX – New Vancouver Office 11th Jan 2024